News

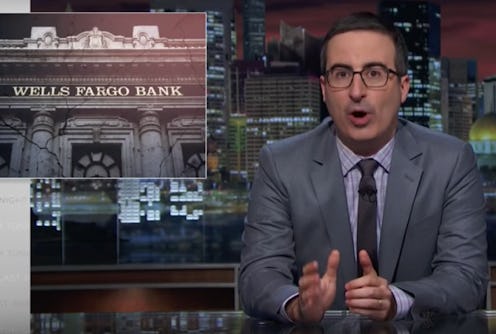

John Oliver Took Wells Fargo To Task

This may be the first John Oliver segment that has ever personally insulted me, even if his greater message is more than fair. Monday on Last Week Tonight, Oliver brought attention to the Wells Fargo banking scandal. But he made fun of Winthrop in The Music Man in the process, a role I once played as a kid — not cool, Mr. Oliver. Not cool. But, man, was he ever right in his takedown of the bank.

In the musical — the movie version saw Ron Howard play Winthrop — the Wells Fargo wagon was a-comin' in to town, and River City was beyond excited. That's probably the opposite feeling that the bank's customers are having right now. Oliver explained just how bad things are these days at the bank.

Back on Sept. 8, the bank issued a statement acknowledging that it had come to an agreement to pay $185 million in settlements to various regulatory bodies because customers were receiving products they did not request like credit lines or credit cards that all said and done accrued $2.6 million in associated fees for the bank. Oliver assumes you're shocked, but it's really true:

That's right. Wells Fargo employees created fake email addresses to enroll customers in hidden accounts, creating PIN numbers the customers didn't even know existed — and hidden fees are bad enough without being hidden inside hidden accounts with hidden PIN numbers made with hidden email addresses. Because that's like a Russian nesting doll where the last doll is giving you the middle finger.

But perhaps that's not even the most ridiculous part. There were more than 2 million accounts that were opened, and some customers had as many as 10. One was Frank Ahn, a small business owner, who was part of L.A.'s original lawsuit against the bank. "I called the 800 number and said I want them canceled. They would cancel them, but more would pop up later," Ahn told the Los Angeles Times. Oliver featured him in the segment, only to give him a bit of advice:

Look, Frank, I do not want to let Wells Fargo off the hook here, but after 10 accounts, any bank would have been better. Chase Bank, Citibank, even Elizabeth Banks would have been a better place to stash your money.

More than 5,000 people were fired as a result of the case, but Oliver wondered aloud why there were so many of them, before airing a segment that implied the process was systematic within the bank. He really laid into it, even more so, when talking about the bank's CEO John Stumpf. He was called in to testify last week in front of the Senate Banking Committee. Oliver took him to task for saying he did not know "anything about anything."

The biggest problem, though, by Oliver's estimation, is the size of the settlement. "The total fine for Wells Fargo's behavior was $185 million, which is nothing considering they made $23 billion in profit just last year." That's also less than Stumpf would receive if he resigns from the company: CNN says he'd take home about $200 million. Oliver doesn't get it:

The only way that could possibly be okay is if they could put that money into 20 million fake accounts of $10 each and never, ever tell him about them.

Who knows? Maybe the Senate Banking Committee will like that solution.