News

What You Need To Know About Equifax, Transunion, And Experian

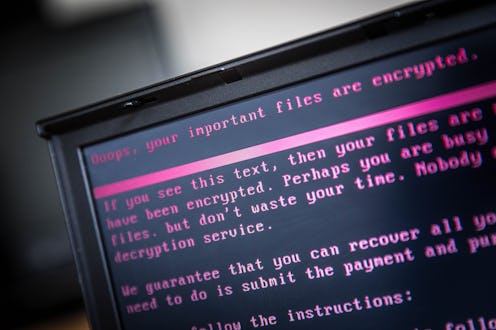

Last week, the credit rating agency Equifax was hit with a massive security breach, one that reportedly had a huge impact on the identity and financial information of millions of people. In fact, according to reports, up to 143 million Americans may have had their data breached, a mind-blowing number in a country of about 320 million people total. And it's possible you're feeling worried even if Equifax wasn't the credit reporting agency of choice. After the hack, you might be trying to figure out whether Equifax, Transunion, and Experian are the same company. In other words, will one of them being hacked affect the others?

The simple answer to the question is no, the three companies are not the same. Rather, they're distinct corporate entities, and competitors within the narrow field of credit reporting agencies. As such, Equifax being hacked won't affect you if you've exclusively used, say, Transunion.

However, the underlying reality that's raising these concerns is that Experian and Transunion ― the largest and third-largest credit reporting agencies operating in the United States, respectively ― perform much the same function as Equifax, handling the same sort of hyper-sensitive personal and financial information. As such, the potential for those companies to be hacked in similar fashion to what just happened to Equifax does exist, and therefore the people who rely on their services might be feeling wary right now.

Back in 2015, in fact, Experian was hit with a hack that compromised 15 million customers' data. That's a far cry from the eye-popping figure being cited in the Equifax hack, but it nonetheless highlights the potential pitfalls of so many aspects of American life effectively demanding that people get credit checks through this trio of companies.

If you're seeking residence as a renter, for example, credit checks are often unavoidable. A low credit score can keep a landlord from renting to you, and the only way to verify what score you have is to get it checked through one of the three agencies. The way they calculate scores can often vary widely, too, meaning you might get a different result depending on which you use.

Thus far, there has been no information released publicly regarding who was responsible for the Equifax hack. The company has said via a statement that social security numbers, addresses, and driver's license numbers were compromised.

The information accessed primarily includes names, Social Security numbers, birth dates, addresses and, in some instances, driver's license numbers. In addition, credit card numbers for approximately 209,000 U.S. consumers, and certain dispute documents with personal identifying information for approximately 182,000 U.S. consumers, were accessed. As part of its investigation of this application vulnerability, Equifax also identified unauthorized access to limited personal information for certain UK and Canadian residents. ... The company has found no evidence that personal information of consumers in any other country has been impacted.

The upshot is that, as an adult making their way through modern American life, you're sometimes presented with situations that more or less demand you submit to a credit check, and as such, there's a very good chance one of those three companies has some of your highly sensitive data. If it's Equifax, of course, you're probably already sweating the possibility that your information has fallen into the wrong hands.

Cybersecurity issues for major companies have loomed large in recent years, perhaps most memorably when the massive Yahoo hack that took place in 2014 compromised some 500 million people's information. The United States ultimately blamed that hack on Russian agents, a foreshadowing of the swirl of allegations of Russian interference in the presidential election that would unfold just a couple of years later.