News

Here's Why You Should Reach Out To TransUnion About Your Credit Information, Too

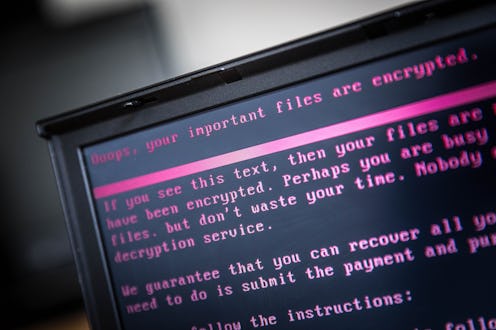

The massive data breach at Equifax has huge implications for you and your personal finances. The possibility of identity theft in a data leak like this one is significant because the kind of information that the hackers received is what could be used to open a new account like a credit card or some other sort of loan. What is then most important to understand is that Equifax is just one of three large credit reporting agencies — you should also consider contacting TransUnion to ensure no fraudulent activity occurs.

But before you do this, you need to double check if your data has been hacked. Not all Americans were affected by the breach, although 143 million is quite a large proportion of the country — some experts say more than half of all people in the country who have a credit report. To do this you can contact Equifax or check on their website. In theory they will contact you to inform you that your data was breached, but there is no law that requires them to do so within a certain time frame.

If you were part of the breach, it means your name, Social Security number, birth date, addresses and possibly driver's license number were obtained by fraudsters. (That's the information needed to open all sorts of accounts, so you don't want to take this lightly.) You're potentially going to want to contact TransUnion, in addition to the breach offender Equifax and the other big competitor Experian. The companies can freeze your account to make it harder for criminals to commit fraud.

To contact TransUnion, you have many options, both online, in the mail, and by phone — which is probably easiest. You need to know what you're calling it about, though. Among the options are to request a credit report, dispute a problem, or freeze your credit history. If you do decide to freeze your account, you can do so by calling (888)-909-8872 or visiting its website. If you prefer snail mail, you can get the mailing address on their website.

The way freezing an account works is that it allows for an extra stop-gap measure between thieves and their ability to open an account in your name. Currently, thieves could apply for a credit card online with your information and be approved instantaneously — that would be bad. With a freeze, the credit card company wouldn't be able to access your credit history to know whether or not to grant the application. This process costs between $5 and $10, depending on the state you live in. In certain instances, it can even be free.

Freezing your credit does make it a little complicated for you to take out your own lines of credit, however. It's difficult, but not impossible: You call the credit agencies and tell them that you need a thaw. They must comply within three days and you can decide how long to leave the window open, essentially until you have been granted or denied the requested credit (a home mortgage, car loan, or whatever the case may be).

If you weren't part of the breach, it's still a good idea to keep a handle on your credit score and your account to make sure that no errors have been added, like late payments that were actually on time. The same routine monitoring would also show you if there is fraudulent activity. You can get a free credit report by visiting the website AnnualCreditReport.com, a website set up after the government mandated free credit reporting.

Ultimately, there's no way to be 100 percent sure that criminals won't take advantage of this leak. But now, by contacting TransUnion and the other firms, you can take steps to protect yourself.