Life

Our Parents Are Broke & So Are We. Now What?

For the last four years, Michelle Thompson, a 22-year-old communications associate at a civil engineering firm in Salt Lake City, has been helping her mom get by. “Since the age of 17, I've bailed my mom out at least once a year when she had expenses that she didn’t foresee or budget for on her paycheck-to-paycheck lifestyle,” Thompson tells Bustle.

Earlier this year, Thompson and two of her sisters had to cover the cost of her grandmother’s funeral when her parents couldn’t afford it. When her mother needed to move because she could no longer afford her house a few months ago, Thompson helped fund that, too. Now, as she looks towards the future, Thompson is worried that her mother’s financial insecurity has denied her the ability to build a safety net for herself. “I’ve had to constantly use my savings to help my family,” she says. Even as a teen, Thompson worked part-time and paid for dance lessons and other extracurriculars for her four younger sisters so they wouldn’t miss out.

“I was trying to snowball my debt before, but I had to give money to my mom.”

As baby boomers edge closer to retirement or the inability to work, and millennials are struggling to gain financial freedom (after amassing the largest student loan debt in history), experiences like Thompson’s are becoming increasingly common. Of course, children have always been tasked with taking care of their aged parents — but something different is happening here. For the first time in American history, economists predict that young people will be worse off than previous generations, and that has a lot to do with the fact that on top of their own unique financial and socio-economic struggles, they’ll be on the hook for all their parents' debt, too.

“Right now, I have about $22,000 left to pay on my student loans,” Thompson says. “I was trying to snowball my debt before, but I had to give money to my mom to help pay for the house when my grandma died. Now, I'm just paying a little more than the minimum payment each month.”

There are innumerable political, economic, and social divides between baby boomers and millennials, but money — who has it, who needs it, who gets to spend it and how — is arguably the most stark. By every indication, millennials are broke, whereas baby boomers are now the wealthiest generation in the history of US. According to a 2015 Gallup poll, more than 50 percent have over $100,000 of investable assets on hand, while one in five have over $500,000. In fact, segments of this age demographic have so much money, they won’t even be able to spend it all before they die (even after 50 percent of them give $250 worth of financial help to their millennial children every month). “Millennials are going to experience the largest transfer of wealth in the world’s history,” Bill Ryon, the co-founder and managing partner of Compass Investment Advisors, tells Bustle. “But that’s all going to the kids of about half of baby boomers. The other half will be getting essentially nothing.”

A snapshot of what this "other half" looks like is a snapshot of income inequality writ large in the US. Women continue to make 83 cents for every dollar that men do, fare worse financially post-divorce, and invest far less than men do over the course of their lifetimes — all factors that make them more likely to depend on their kids for support later in life. And America’s racial income gap appears to be widening, instead of shrinking. White, middle-class households own nearly eight times as much wealth as middle-income black households—and experts predict that if current trends continue, it will take 228 years for the average black family to reach the same level of wealth white families have today.

“I’m sure she’ll end up living with us.”

“The 50 percent of baby boomers who aren’t wealthy don’t have much at all, and will live out their retired years on social security, help from family and friends, and possibly a pension if they have it,” Ryon says. Recent studies also suggest that many folks in the older generation haven’t saved nearly enough for retirement and a majority aren’t financially prepared to maintain their lifestyles after they can no longer work. There’s also research to suggest that seniors in the U.S. struggle more to pay for their healthcare than the elderly in other affluent nations do. “It’s these folks that will be a potential burden on their children,” Ryon adds.

Thompson says she tries not to obsess about what will happen if her mom stops being able to work or requires full-time care down the line, but as the second-to-oldest kid in her family, she knows it will impact her. “I know that it will probably be me or my older sister who ends up taking care of her,” she says. “I’m sure she’ll end up living with us.”

For most of us, thankfully, this situation is still theoretical. As Ryon notes, the first baby boomers to officially retire did so in 2010: “Some of [the children of baby boomers] are still very young, so we haven’t begun to see the full effects of this financial divide yet.”

This, of course, is not the case for Thompson, and the effects of taking care of her mother’s finances are far reaching. While her relationship with her mother is still good, she says they aren’t really able to plan for her future or discuss her financial situation openly because her mom gets uncomfortable talking about money. She also shares that her father is now estranged as a result of the family’s financial woes.

“I began financially supporting my mother in my late 20s and will be doing so for the foreseeable future.”

“I haven’t spoken to my dad since my grandma passed in March,” she says, noting that her dad had a rough childhood and dropped out of high school as a teen. “My parents had been living in the same house up until then, but their marriage had been strained because of finances. After my grandma died, my mom asked him to leave, but I was the one who ended up confronting him and telling him it wasn’t fair that I was doing his job, essentially, by giving my mom money, and explaining to him that it was in everyone’s best interest if they separated. He left the next day and hasn’t reached out to me since then.”

Thompson also confesses that her mother’s lack of financial stability makes her reticent to start her own family. She says she never wants to find herself in a position like the one her parents were in — unable to pay for their kids’ dance lessons and struggling to pay the bills.

Even when millennials are able to independently gain their own financial footing, they can still face the consequences of their parent’s financial situations, which can lead to a lot of uncertainty about the future.

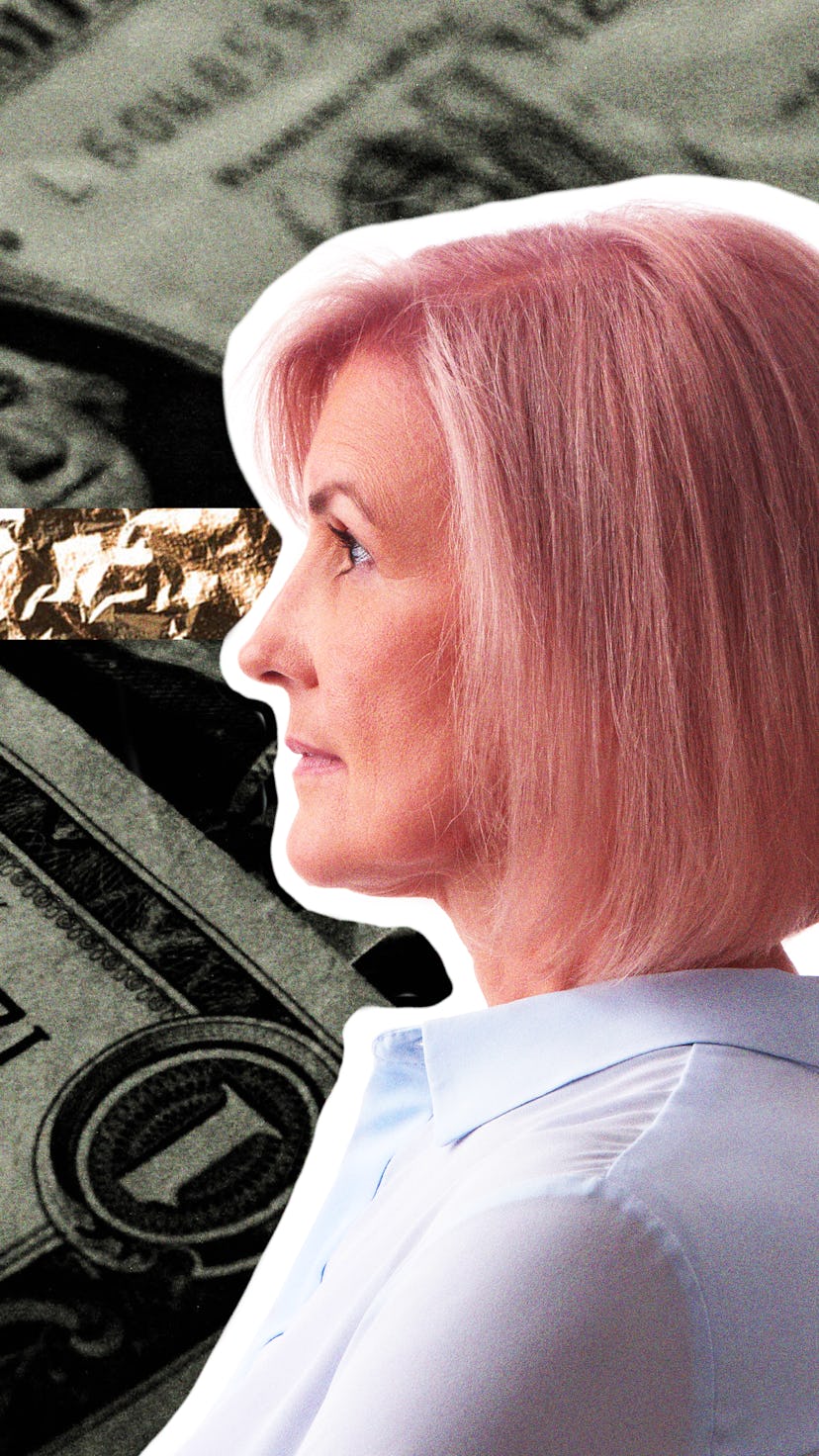

Lyn Alden, a thirty year old who lives near Atlantic City, New Jersey, shares Thompson’s fear of doing to her own children what her mother did to her. “I wouldn’t want to have kids unless I was 100 percent rock-solid financially,” Alden tells Bustle.

Thing is, Alden is financially “rock solid” by most people’s definition. In addition to being an engineer who builds aircraft simulators for a living, she’s something of a financial whiz. She holds a master’s degree in engineering management with a focus on economics and financial modeling, and as a side-hustle she runs an investment strategy website where she provides market research on income-generating investments to individual investors and financial professionals. After graduating in 2010 with just under $50,000 in student loans, Alden managed to pay them off completely in five years, all on her own.

"She didn’t save any money for retirement during her career, and had to retire early due to disabilities."

She’s not where she’d like to be financially yet, though, because like Thompson, she has to support her mom.

“I began financially supporting my mother in my late 20s and will be doing so for the foreseeable future,” Alden says. “She didn’t save any money for retirement during her career and had to retire early due to disabilities, which cut off her earning power.”

An only child, Alden began taking care of her mother after her dad passed away four years ago. Her mom, who is unable to work due to bipolar disorder and PTSD, gets her primary support from Social Security and Medicare, but Alden gives her several hundred dollars each month to help cover the cost of food and other basic necessities. She also regularly picks up the tab for bigger ticket items like vet bills for her cats and car repairs.

“She’s had money problems for a long time,” Alden says. “Her sister supported her before I did.”

Watching her mom’s situation unfold was a cautionary tale. “I’ve been the total opposite,” Alden says. “I have a really high savings rate and focus a lot on building wealth and building investment income streams. When I had to start supporting my mom, I went out and increased my side hustle to try and offset some of what I pay for her.”

Alden certainly isn’t the only millennial to pick up a second job or create additional revenue streams — but there’s no amount of hustling that can solve the burden that boomer parents are collectively laying on their adult children. The wealth gap in the US is significantly larger than it is in the rest of the developed world, and it’s likely to widen as the disparity between millennials who receive money from their parents and millennials who have to financially support their parents continues to grow. As the middle class shrinks, we’re likely to see an increase class-based social segregation as well, which, as any kid with broke parents will tell you, could prove to be incredibly painful for those left behind.

"Lots of the young people who aren’t going to inherit will solve their problems some other way through work. They always have."

Thompson knows this pain firsthand. She attended a private college in Salt Lake City, where she says a majority of the students came from “really wealthy, upper class, very white families. It took me a good three years of college to even feel OK around people like that,” she says. “You can’t help but compare yourself when you’re driving a shitty, beat-up car that you’re praying makes it home the next day while they’re all driving BMWs their dads bought them.”

An increase in income inequality will likely impact our political outlook as a generation, too. After all, the wealth gap, and the limited social mobility and feelings of disenfranchisement that come with it, have been cited as the driving forces that got Donald Trump elected.

Despite all of that, though, Ryon remains optimistic that young people will figure it out.

“There are always forces at work that are generating the next new thing, whatever it is,” he says. “Pieces of technology, processes, policies, systems that will create new businesses. Lots of the young people who aren’t going to inherit [wealth from their parents] will solve their problems some other way through work. They always have. All of history it goes that way. So it’s not dire. It’s not the end of the world.”

It might not be literally the end of the world, but it can certainly feel that way for people who are struggling to pay rent while also responsible for their parents. There are some things millennials can do right now to lighten the load, though, and decrease some of their financial anxiety about the future.

First thing’s first, according to Ryon: If your parents are still working and financially able to save, it’s not too late to help them change course and save more for retirement.

“This requires frank, open, and often uncomfortable conversations with family members,” he says. “But it is absolutely worth doing.”

“Don’t make the big mistake of stopping working to take care of them.”

If you’re not a financial expert like Alden, Ryon says your best bet is to get your parents to sit down with someone who is. If their company offers a retirement plan, they’ll often have free access to the advisers who manage those accounts. He also points to websites like Personal Capital, Investopedia, and StockCharts as good starting points for learning more about asset allocation, investing, and long-term wealth management. Even if they don’t have much disposable income to spare, Ryon says it’s well worth learning how to put a little bit away every month now, so it has time to grow by the time they retire.

No one wants to think about their parents getting sick or passing away, and for people whose parents are still relatively young and healthy, it can seem unnecessarily painful to talk about. But, now is the time to consider buying long-term care insurance or even life insurance policies for them. That way, if you wind up supporting them towards the end of their lives, you'll have help covering costs when they are infirm and getting back on your feet financially after they're gone.

Ryon says notes that if your parents do require full-time care at some point, you should absolutely keep working if it is at all possible. “Don’t make the big mistake of stopping working to take care of them,” he says. “Keep working. You’ve got to take care of yourself and your own future.”

“Live simply. Learn how to invest. Build up as much of a cushion as possible."

If it's impossible to work and care for your parents at the same time, many companies do offer paid leave for employees who are taking care of sick or elderly family members, so be sure to look into those policies if this is a concern for you. Having this level of awareness and control of your own financial future is the most important part of this equation.

Ryon and Alden both recommend that millennials in the workforce do what so many of our parents didn’t and take charge of our own financial futures early on.

“Try to get a side hustle and save extra money,” Alden says. “Live simply. Learn how to invest. Build up as much of a cushion as possible, so when you have unforeseen events like having to take care of your parents, it doesn’t totally derail your finances.”

It sounds morbid, but these good habits will last longer than your parents will. And if you start caring for yourself financially now, you'll be less likely to hit your own kids up for cash when you're in your 60s. As many millennials now know too well, that's a future worth saving for.

Correction: A previous version of this piece misattributed one of Thompson's quotes to Alden. It has been updated for accuracy.