News

These Revelations From The Paradise Papers Could Shake The Whole World

A recent leak of a trove of documents pertaining to offshore finance and the tax haven industry has generated bombshell revelations about how the world's rich and powerful invest in secret. Investigative journalists at several media outlets have obtained some 13.4 million leaked files called the Paradise Papers. Among these are some 6.8 million documents related to an offshore law firm with a lengthy list of clients.

The papers were first obtained by the German newspaper Süddeutsche Zeitung and then later shared with the International Consortium of Investigative Journalists (ICIJ), which has been investigating the financial secrecy and the offshore finance industry for at least four years now. The independent U.S.-based but global network of journalists also worked on the Panama Papers in 2016. It is not known how Süddeutsche Zeitung first came to possess the leaked documents and Appleby, the offshore firm often mentioned in the documents, has denied any wrongdoing.

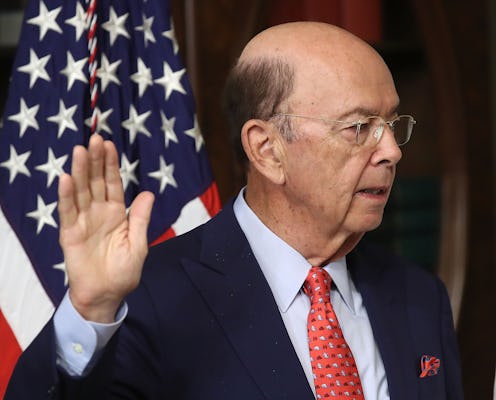

"The Paradise Papers reveal offshore interests and activities of more than 120 politicians and world leaders," the ICIJ said Sunday in a post announcing the release of the papers. According to the ICIJ, the papers include data on U.S. Commerce Secretary Wilbur Ross and at least 12 other allies, major donors, and members of President Donald Trump's Cabinet, including a business associate of Jared Kushner. The activities and investments of Queen Elizabeth II, Bono, Apple, Nike, and Facebook are also reportedly featured in the papers in one way or another.

Many of the dealings laid out in the Paradise Papers are methods companies and individuals use in an effort to avoid paying taxes. If done following the rules, which the leaked documents prove some were not, these tax avoidance schemes are completely legal. But whether or not these schemes are fair or moral is an entirely different question. One that's currently being heavily debated as the Paradise Papers bring to light a series of revelations that could shake the world.

Here are some of the biggest revelations the Paradise Papers have brought to light so far:

Wilbur Ross

Nestled in the Paradise Papers was the revelation that Wilbur Ross, President Trump's commerce secretary, reportedly retained his investments in a shipping firm with significant ties to a Russian gas company partially owned by Russian President Vladimir Putin's son-in-law even after taking office. The shipping firm reportedly operates a partnership with the Russian gas giant Sibur. According to the Guardian, Putin's son-in-law Kirill Shamalov is part owner of Sibur, and at least one of the company's other major shareholders— Gennady Timchenko — is currently under U.S. sanctions. The partnership means Ross could benefit financially from a company owned by close allies of Putin.

"Secretary Ross recuses himself from any matters focused on transoceanic shipping vessels," a spokesman for the Commerce Department told BBC Panorama. The spokesman also said Ross "works closely with Commerce Department ethics officials to ensure the highest ethical standards."

Yuri Milner

Documents in the Paradise Papers have revealed Russian billionaire investor Yuri Milner — who invested in one of Jared Kushner's business ventures through a family trust — facilitated significant investments in both Facebook and Twitter for two Russian state institutions. Milner reportedly invested money in the two social media networks that he'd received from the Russian state-controlled VTB Bank and the financial arm of Gazprom, an oil and gas firm which is majority owned by the Russian state. Through Milner VTB Bank invested $191 million in Twitter in 2011 while Gazprom held an offshore company that financed a vehicle holding Facebook shares worth $1 billion, the Guardian has reported.

According to the New York Times, the companies Milner used for the investments ended up owning 5 percent of Twitter and more than 8 percent of Facebook. Those holdings have reportedly since been sold. The Times also claims VTB Bank is often used by the Kremlin to make "politically strategic deals," raising questions about how Facebook and Twitter may have played a role in Russia's interference of the 2016 U.S. election.

Gary Cohn

According to leaked documents included in the Paradise Papers, Gary Cohn, Trump's chief economic adviser — and the man heading the White House's tax reform efforts — was involved in the offshore finance industry. Trump has recently vowed to "bring back trillions of dollars from offshore." Cohn, however, was reportedly named as president or vice-president of 22 separate Bermuda entities between 2002 and 2006 while employed as an executive at Goldman Sachs, the Guardian has reported. Those Bermuda entities were reportedly focused on real estate. It should be noted that the Paradise Papers includes no evidence that Cohn's dealings were done illegally.

Rex Tillerson

The Paradise Papers have also revealed Secretary of State Rex Tillerson was a director of an offshore Bermuda-based firm known as the Marib Upstream Services Company at the same time he ran the Yemen division of ExxonMobil, which had ties to the offshore firm. Again, it should be noted the leaked documents do not include any evidence Tillerson's dealings were illegal. Yet they remain noteworthy given the Trump administration's repeated promises to bring back the trillions of dollars U.S. companies have settled offshore.

Queen Elizabeth II

The British monarch reportedly invest some $13 million of her private money offshore, according to documents included in the Paradise Papers. Established in 1399, the Duchy of Lancaster is the private estate of whomever happens to be the British Sovereign. It seeks to provide a private and independent income to the Sovereign via a grouping of financial assets such as land, property, and trusts. According to the Paradise Papers, the Duchy of Lancaster, placed more than $10 million into funds based in Bermuda and the Cayman Islands for Queen Elizabeth.

While there appears to be nothing illegal about the Queen's investments, some have questioned whether she, as England's queen, should be investing offshore to begin with. A spokeswoman for the Duchy told the ICIJ that the queen voluntarily pays tax on all income she receives from the Duchy and the investments it makes. "The duchy's investment policy is based on advice and recommendations from our investment consultants and asset allocation rather than tax strategy," the ICIJ reported the spokeswoman said.

Like the Panama Papers before them, the Paradise Papers have stirred significant debate about the offshore finance industry. Critics of such tax havens claim these systems often allow the so-called ultra-rich to reap the benefits of business dealings in law-based countries without contributing their fair share in return. The full impact of the Paradise Papers likely won't be known for a little while. Still, in only the first day of their release the documents are shedding serious light on how wealthy individuals and large corporations use tax havens to avoid taxes in a way that's simply not possible for the rest of us.

Correction: This article has been updated to more accurately reflect Yuri Milner's involvement in one of Jared Kushner's business ventures.