Money

The Viral "Snowball Method" Helped A TikToker Pay Off $15,000 Of Debt

Start small.

When you’re staring at a pile of debt — credit cards, loans, medical bills, etc. — it can be tough to figure out how to start paying it all off. It often seems like an impossible task, especially if you’re looking at big numbers.

This is why so many people love the “snowball method.” Created by personal finance expert Dave Ramsey, and currently going viral on TikTok, it’s all about paying off the smallest debts first and then letting your payments “snowball” to the bigger ones from there.

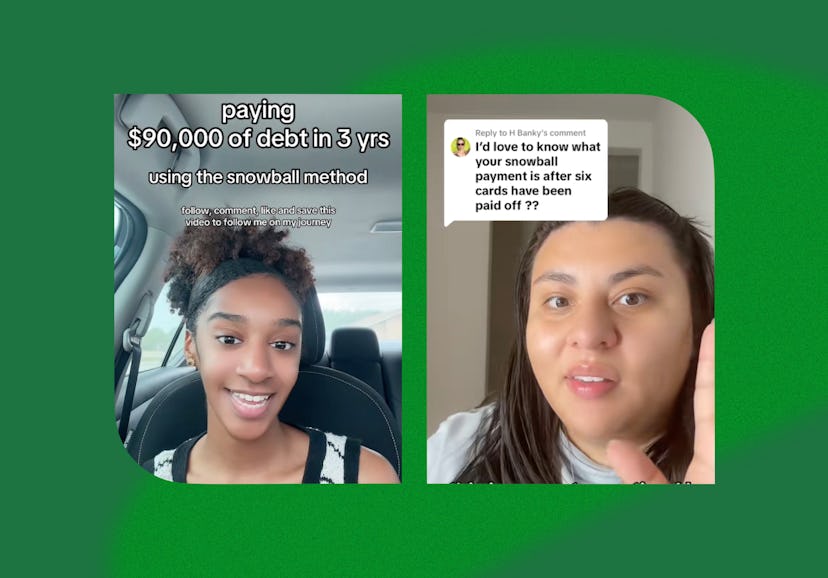

On the app, creator @sydneymerieux said she hopes to pay off $90,000 of debt in three years using this trick. “I know there are a lot of different methods that people use in terms of trying to pay off their debt, but personally, the snowball method made the most sense to me,” she said in a video.

Meanwhile, creator @finfabwiththea has already paid off her debt using this method. She went from having £15,000 in liabilities to being debt-free, buying a house, and leveling up her financial goals. In a viral TikTok, she said the debt snowball method was how she did it.

Think you need a ton of extra money to try it? In another viral video, creator @wheretfisallmymoney explained how to pay off $10,000 in credit card debt in a little less than two years without exceeding $500 in monthly payments. Here’s what to know about this hack and how to give it a try.

How To Do The Snowball Method

According to Deryck Gryne, Sr., a financial advisor at Ally Invest Advisors, the snowball method is a simple, straightforward way to address your money goals.

To begin, list all of your debts, from smallest to largest, making it an ideal strategy for people who have debt from multiple sources or credit cards. Then, focus on a payment goal for the smallest debt while continuing to make minimum payments on the others. Have some extra money, even if it’s $20? Use it on the smallest one.

On TikTok, creator @talkingwithmarlon recommended budgeting or lowering other expenses as a way to funnel more money towards the small debt. The goal is to keep going until the smallest liability is fully paid off, and once it is, move on to the next one on the list.

Why It Works

When you don’t have a clear goal, you might try to pay off too many debts at once and feel like you aren’t making any notable progress. The snowball method makes you focus and stay motivated. As Gryne says, it’s all about small wins that stack up that will help you keep going.

Mistakes To Avoid

Although the focus is on the smallest debt, Gryne reminds you not to forget about any lingering high-interest loans, so be aware of where the debt is coming from to help you prioritize.

If you want to give the snowball method a try, Gryne says budgeting is key so you can “find extra money to put towards your debt” while also addressing your minimum monthly payments, and enjoying your life during the process, too.

“Don’t forget to treat yourself for your small and large victories along the way, like dinner out for paying off a smaller debt or a spa day for paying off a larger debt,” says Gryne. “Stay committed, don’t get discouraged, and make it fun.”

Source:

Deryck Gryne, Sr., financial advisor at Ally Invest Advisors