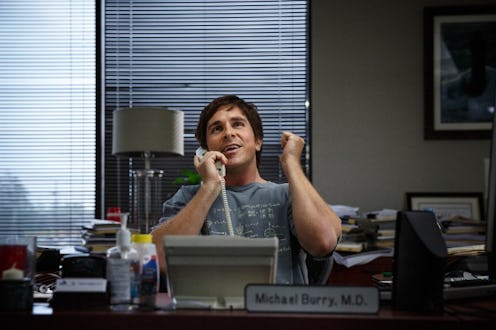

Adam McKay's dramedy about the 2008 financial crisis, The Big Short, is drawing rave reviews and plenty of Oscar buzz, with some even saying the movie makes the confusing housing market meltdown more accessible than it's ever been before. The film's cast is tremendous, with Brad Pitt, Steve Carrell, and Ryan Gosling all playing fictional characters who are based on people who actually saw what was happening in the market. But the most intriguing character of all also happens to be a real person: Dr. Michael Burry, portrayed in the film by Christian Bale. The former neurologist with a glass eye who loves heavy metal is an interesting guy to say the least, though at first glance he hardly seems like one of the great financial minds of our time. So what is Michael Burry doing today?

Burry is still involved in the financial sector, and he's still making predictions about what could go wrong in the economy. At the time of the events depicted in the The Big Short , Burry was the head of the hedge fund he had founded, Scion Capital, LLC. But after making a killing betting against subprime mortgages, Burry liquidated his company in 2008 to instead focus on his personal investments.

But after a few years of laying low, Burry decided to once again become a hedge fund manager. He founded Scion Asset Management, LLC (he really likes the name "Scion", apparently) in 2013, and continues to lead it to this day. And even though you would need a lot of money if you want Burry to professionally manage your finances, the good doctor is still doling out financial advice for free to anyone who will listen. And everyone should listen, because it seems like Burry seems to think another financial crisis could be looming.

In a Dec. 28, 2015 interview with New York Magazine, Burry outlines the problems he still sees in the financial system — and he doesn't think the preventative measures put in place by the government are helping matters.

"The biggest hope I had was that we would enter a new era of personal responsibility. Instead, we doubled down on blaming others, and this is long-term tragic. Too, the crisis, incredibly, made the biggest banks bigger... Banks were forced, by the government, to save some of the worst lenders in the housing bubble, then the government turned around and pilloried the banks for the crimes of the companies they were forced to acquire. The zero interest-rate policy broke the social contract for generations of hardworking Americans who saved for retirement, only to find their savings are not nearly enough... Government policies and regulations in the postcrisis era have aided the hollowing-out of middle America far more than anything the private sector has done. These changes even expanded the wealth gap by making asset owners richer at the expense of renters. Maybe there are some positive changes in there, but it seems I fail to see beyond the absurdity."

In addition to what he sees as failed legislation, Burry also thinks that economically, the country is more or less where it was when everything collapsed — and that's not a good thing.

"We are right back at it: trying to stimulate growth through easy money. It hasn’t worked, but it’s the only tool the Fed’s got. Meanwhile, the Fed’s policies widen the wealth gap, which feeds political extremism, forcing gridlock in Washington. It seems the world is headed toward negative real interest rates on a global scale. This is toxic. Interest rates are used to price risk, and so in the current environment, the risk-pricing mechanism is broken. That is not healthy for an economy. We are building up terrific stresses in the system, and any fault lines there will certainly harm the outlook."

So what's a person to do? Well, if you want to invest like Burry does, take a look at some water. The Big Short mentions at the end of the film that Burry has turned his investing eye toward water, which may sound strange, but he explains it as a commodity whose demand is guaranteed to always be in demand.

"Fresh, clean water cannot be taken for granted. And it is not — water is political, and litigious. Transporting water is impractical for both political and physical reasons, so buying up water rights did not make a lot of sense to me, unless I was pursuing a greater fool theory of investment — which was not my intention. What became clear to me is that food is the way to invest in water. That is, grow food in water-rich areas and transport it for sale in water-poor areas. This is the method for redistributing water that is least contentious, and ultimately it can be profitable, which will ensure that this redistribution is sustainable. A bottle of wine takes over 400 bottles of water to produce — the water embedded in food is what I found interesting."

So to sum up, Michael Burry is still managing a hedge fund named Scion and is still critical of the way the financial system is being run, but now he's more interested in water than real estate. The 44-year-old is still sharing his opinions on the market, and given how correct his predictions were in The Big Short, it would probably be wise of everyone to listen.

Images: Paramount Pictures; giphy.com