Money

If You Struggle To Stick To A Budget, Open A Second Checking Account

Here's why it works.

If you’ve tried every money-saving trick in the book — the 1% rule, last digit hack, 100 envelope challenge — but still feel like you’re blowing through your budget, it might be time for one tiny tweak: opening a second bank account.

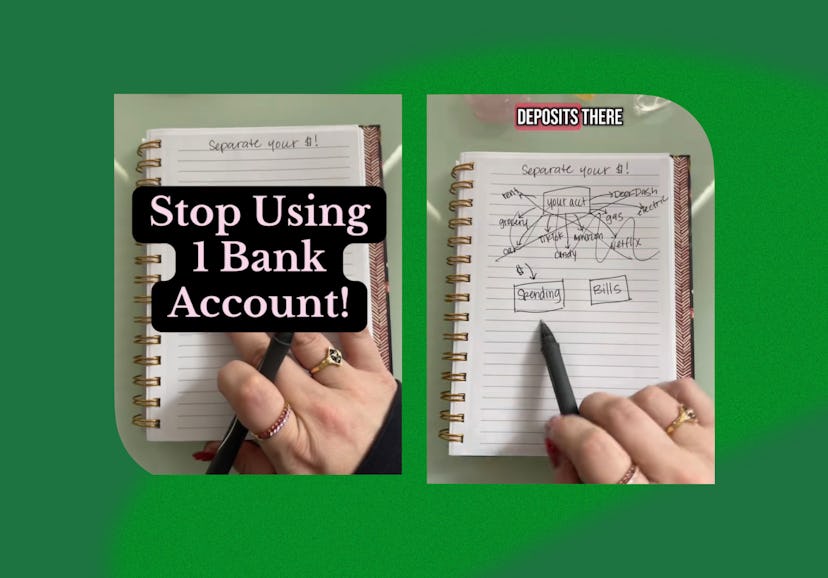

In a viral TikTok, creator @hermoneymastery discussed the benefits of having two bank accounts, one of which is that it can make saving easier. “You need to create some separation with your money,” she said in the clip, which now has over 32,000 likes. “[Having two accounts is] going to help you manage it better, and it’s going to actually help you hit your goals a lot faster.”

When you’re busy swiping your card and paying bills, all coming out of one account, you may be more likely to get to the end of the month with nothing left — and definitely without any extra money to set aside in savings. “Everything’s just flying out everywhere,” @hermoneymastery said, pointing to subscriptions, groceries, bills, and rent, as well as all the little snacks and food delivery you might buy throughout the week.

By opening two bank accounts, the dreaded “where did my money go?” moment can be avoided. In her comments, someone said, “This is what I did and it made such a HUGE difference in my life.” Another wrote, “Did this a couple of months ago. Helped me so much! Used to struggle with overdraft fees. I no longer deal with that.” Here’s what to know.

Why You Need Two Bank Accounts

According to Cindy Kumar, CEO, CPA, and Fractional CFO at Elevated Accounting, having one checking account is really common, but it’s also an easy way to overspend accidentally. “When rent, subscriptions, groceries, and fun spending all come from the same place, it looks like you have more money than you really do,” she tells Bustle. The balance might feel high after payday, but then you chip away without even realizing it until there’s not much left.

This isn’t a sign that you’re necessarily bad with money, Kumar says, but that all of your resources are mixed together with no structure, making it difficult to organize and keep track of your finances. By opening two bank accounts, you instantly gain more control.

Alongside your savings account, which you should definitely have, Kumar recommends opening one checking account for bills and non-negotiables (rent, car payments, debt, insurance) and a second checking account for day-to-day spending (groceries, gas, shopping, coffee, dinner). “That separation protects your essentials and lets you use your spending account without worrying you’re touching money meant for bills,” she says.

The goal with this hack is to give your money more structure, so you can have peace of mind knowing your bills are covered. “That lowers anxiety and gives you freedom to enjoy spending from your other account,” Kumar says. “It also builds confidence. It’s a small change that moves you from reacting to your balance to being in control of it.” At the end of each month, you may even have more money left over than usual to put into savings.

How To Open A Second Account

Creating another account is super easy. “Most banks let you open a second one online in minutes,” Kumar says. “The key is making sure you’re not paying unnecessary fees. Some banks waive them if you keep a minimum balance, and many online banks or credit unions let you create no-fee accounts you can label for different purposes like ‘Bills,’ ‘Spending,’ or ‘Vacation.’”

Once you open your new account, establish the original as the one for spending and the second for bills, which you shouldn’t touch at all except to pay rent, utilities, and other necessary recurring payments. Have your paycheck direct deposited into your spending account, and then move the money needed for any bills to the other. If you can, do a lump sum, since some banks limit the number of free transfers you can make.

To go even further, Kumar recommends using an entirely different bank to open your second account. “When both accounts are at the same bank, it’s too easy to move money back and forth [between them],” she says, pointing to transfers that are easy to do in a few clicks through an app. “Having two banks creates [a little more] friction — your bill money stays untouched at one, and you use the other for everyday spending. That separation keeps you disciplined.”

Source:

Cindy Kumar, CEO, CPA, Fractional CFO at Elevated Accounting